Owner, manager and developer of student accommodation Unite Students has released an update on its current trading and quarterly property valuations for the Unite UK Student Accommodation Fund (USAF) and the London Student Accommodation Joint Venture (LSAV) as at 31 March 2025.

Unite has declared that it continues to experience strong demand from students and universities alike for its student accommodation schemes. The announcement follows the group’s recent annual report that presents a positive outlook for Unite’s operations.

The outlook for student numbers is positive for the 2025/26 academic year, with domestic demand structurally underpinned by a 2% larger population of UK-based 18-year-olds.

Unite expects an increase in international student recruitment this year based on growth in undergraduate applications for 2025/26 and higher issuance of student visas in the year to date.

Additionally, pace of sales has increased since Unite’s preliminary results, with 75% of its rooms now being reserved for the 2025/26 academic year (2024/25: 84%). This is in-line with the group’s expectations for a later sales cycle, following the normalisation in leasing trends in 2024.

Demand from universities is strong for the coming year, as they look to secure accommodation to meet student demand, resulting in nomination agreements for 56% of beds for 2025/26 (2024/25: 56%). Unite states that it remains on track to deliver rental growth of 4% to 5% and occupancy of 97% to 98% for the 2025/26 academic year.

“Student numbers are expected to increase again for the 2025/26 academic year due to a growing UK 18-year-old population and improving trends in international student recruitment.

“Reservations have accelerated in recent weeks, in line with our expectations for a later leasing cycle and are underpinned by nomination agreements from our university partners.

“We remain on track to deliver rental growth of 4% to 5% and occupancy of 97% to 98% for the 2025/26 academic year.”

Joe Lister, Chief Executive Officer, Unite Students

Unite is also in the advanced stages of agreeing a new joint venture with Manchester Metropolitan University to develop 2,300 beds at the University’s Cambridge Halls site in Manchester city centre for delivery in 2029 and 2030.

Elsewhere, Unite is now on-site with the main build contract for its 934-bed Central Quay development in Glasgow. Delivery of the scheme is anticipated for the 2027/28 academic year.

The planning application for the group’s Newcastle University joint venture is expected to go to committee in May, which would enable delivery of the first phase in time for the 2028/29 academic year.

Unite’s 605-bed development at TP Paddington has now been called in by the Mayor of London, following rejection by the local planning committee in February. The group now expects the review process to be concluded later this year (2025).

Unite is continuing to engage with the Building Safety Regulator (BSR) to progress pre-construction approvals for its upcoming development starts and mitigate the risk of delays.

Applications for the group’s London developments at Kings Place and Meridian Square are now under review by the BSR. Unite is targeting approval in the second quarter, which would support delivery in line with its project timetables.

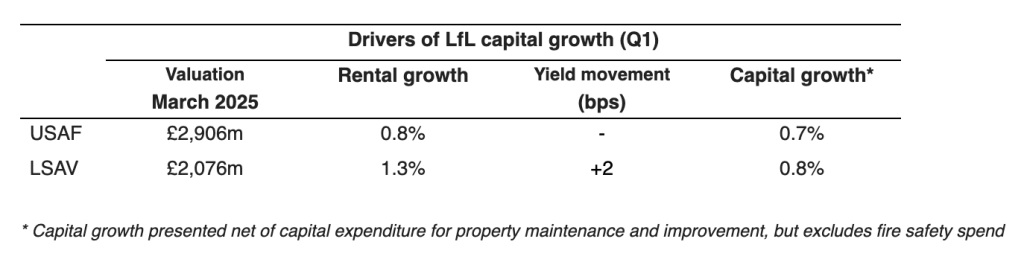

At 31 March 2025, USAF’s property portfolio was independently valued at £2,906m – a 0.7% increase on a like-for-like basis during the quarter. The valuation increase reflects quarterly rental growth of 0.8%.

Unite confirms that property yields were stable over the quarter at 5.2%. The portfolio now comprises 24,326 beds in 61 properties across 19 university towns and cities in the UK.

LSAV’s property portfolio was independently valued at £2,076m – a 0.8% increase on a like-for-like basis during the quarter.

The valuation increase in LSAV is driven by quarterly rental growth of 1.3%, partially offset by a two-basis point increase in property yields to 4.5%. LSAV’s portfolio comprises 9,710 beds across 14 properties in London and Aston Student Village in Birmingham.